jefferson parish property tax rate

Supervisor and Finance Division Commander Danette Hargrave. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

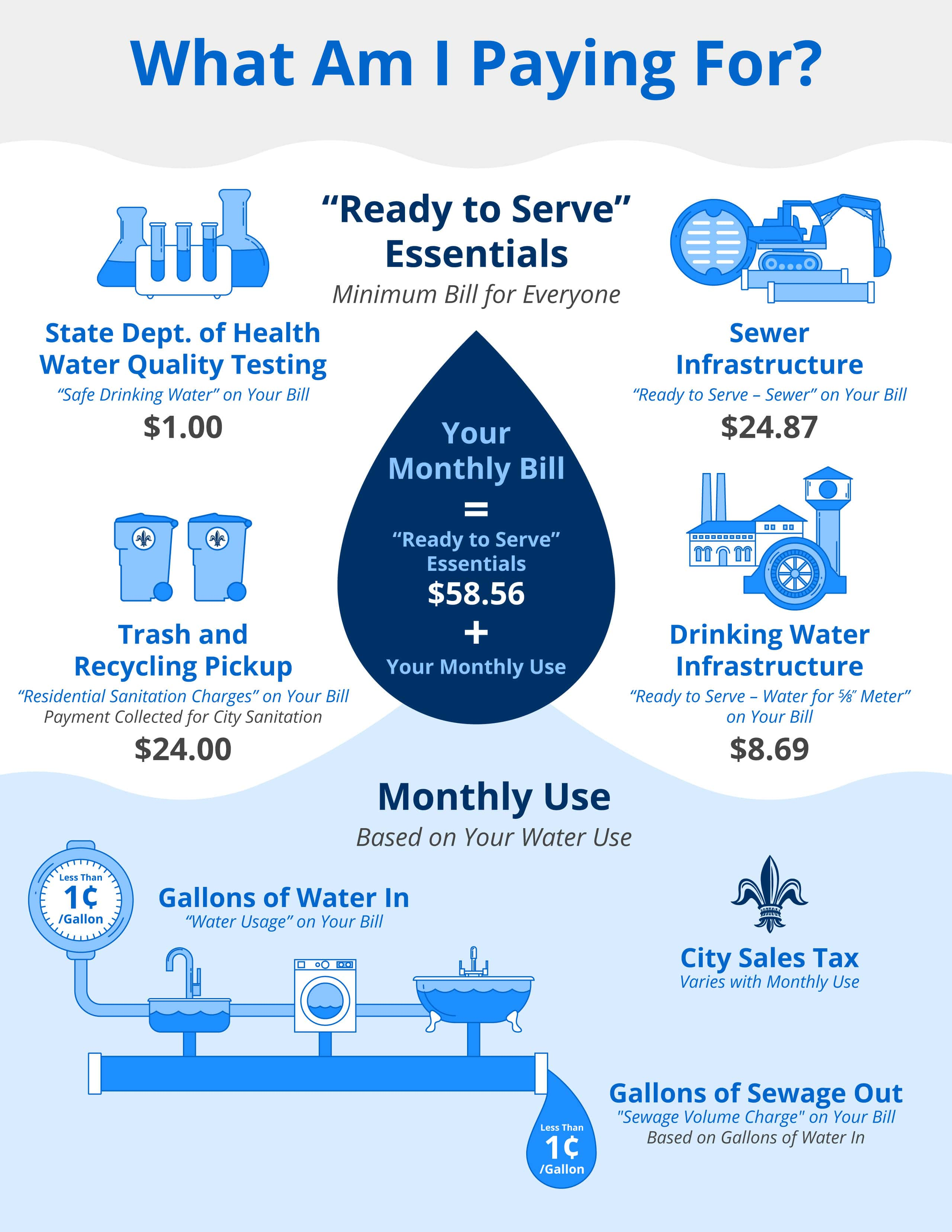

Rates Fees Charges Sewerage Water Board Of New Orleans

The Jefferson Parish Assessors Office determines the taxable assessment of property.

. You must appear in person at either location of the Jefferson Parish Assessors office to sign for the homestead exemption. Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052. This rate is based on a median home value of 180500 and a median annual tax payment of 940.

The Jefferson Davis Parish Tax Division is under the command of Tax Collection Dept. Stocks bonds securities and insurance proceeds to the State Treasurers Office. Find Veterans Affairs.

The parish is named for Founding. If your homesteadmortgage company usually pays your property. The parish is responsible for collecting all property taxes from the middle of November until the day of the tax sale which is generally held sometime in or around June of each year.

The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection law enforcement education recreation and other functions of parish government. Jefferson County collects on average 09 of a propertys assessed fair market value as property tax. This search will take some time because of the size of the parish so please be patient The proposed assessment lists posted on the Tax Commissions website are for informational purposes only and shall not give rise to any claim or contest regarding the assessed value of any property or the taxes due thereon.

Kentucky is ranked 1004th of the 3143 counties in the United States in order of the median amount of property taxes collected. Online filing of wage and tax reports for employers through the wage reporting system of. Search the unclaimed property database to see if any of it is yours.

The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. The median property tax in Jefferson County Kentucky is 1318 per year for a home worth the median value of 145900.

You should bring with you a recorded copy of your act of sale for the property and a photo identification showing the address of the property on which the homestead exemption is being filed. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

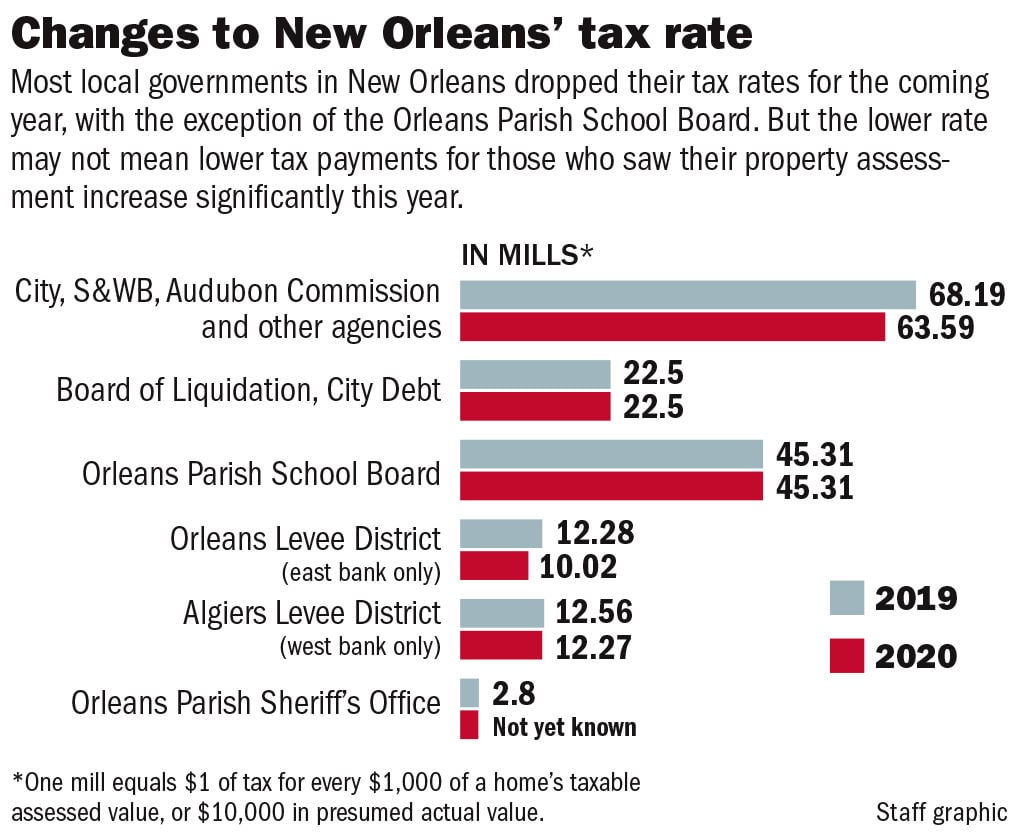

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Louisiana Property Tax Calculator Smartasset

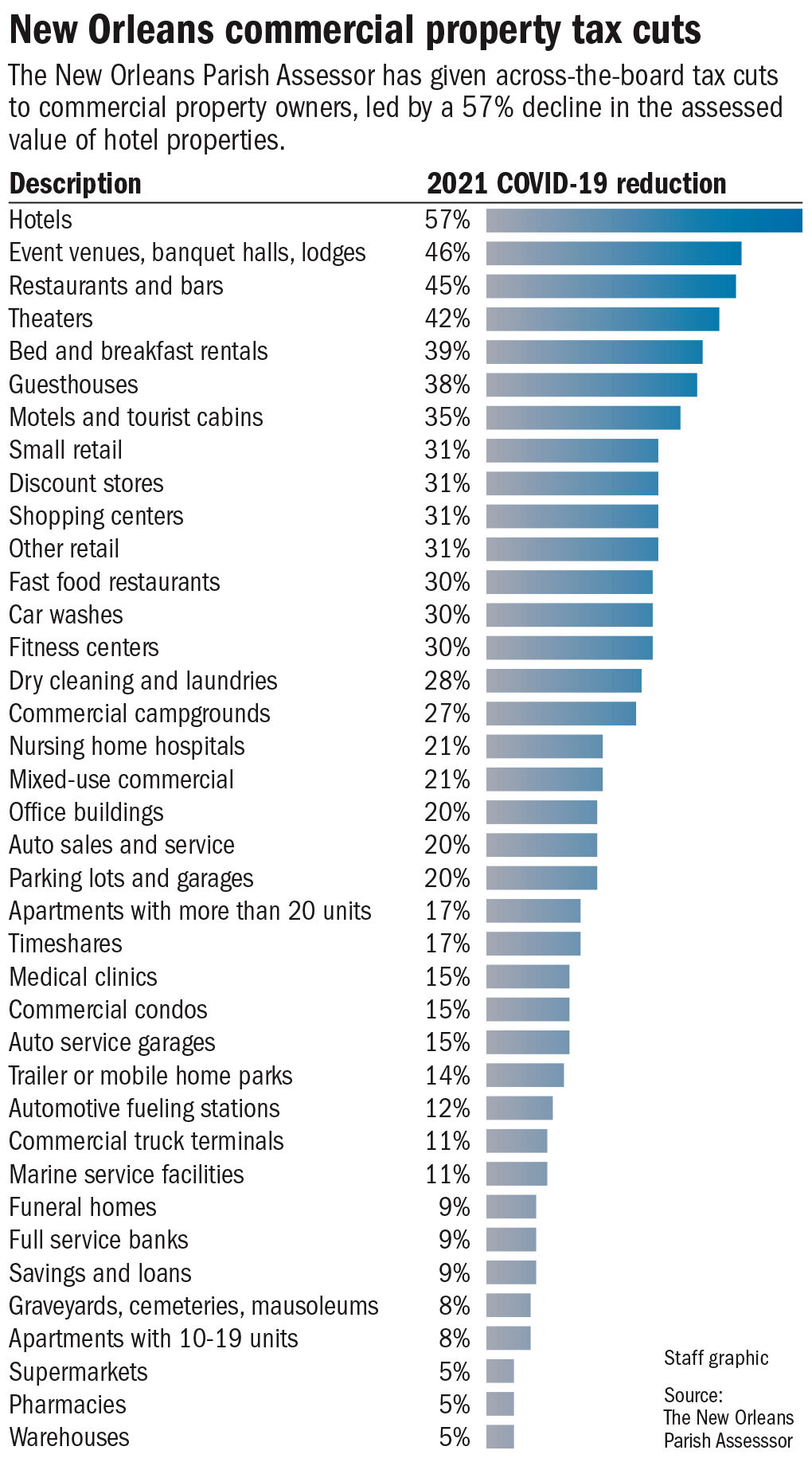

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nola Com

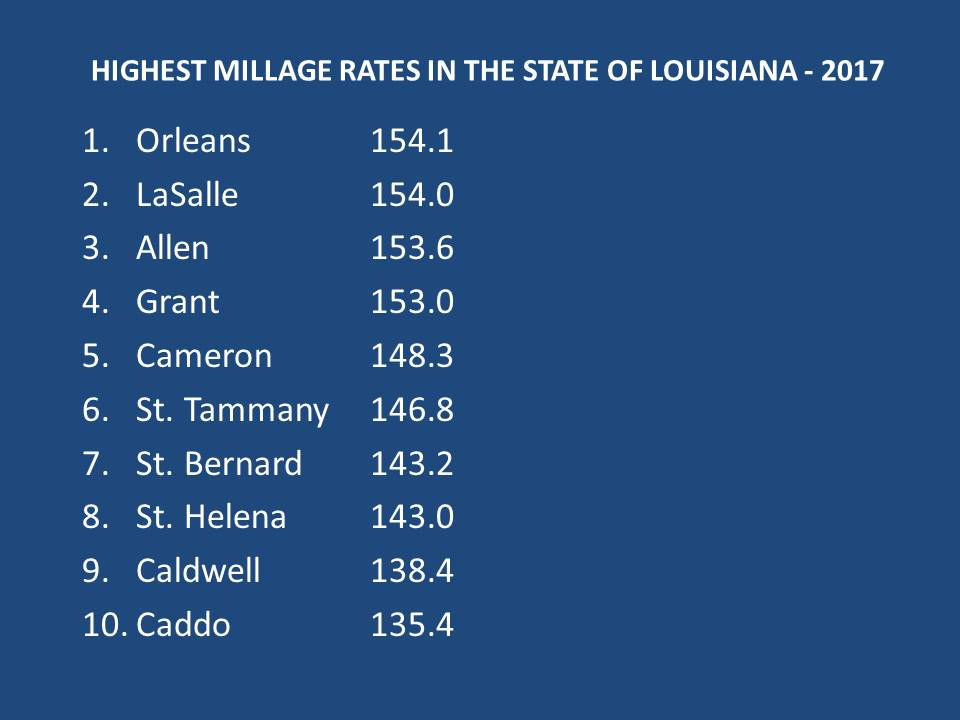

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

Louisiana Property Tax Calculator Smartasset

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

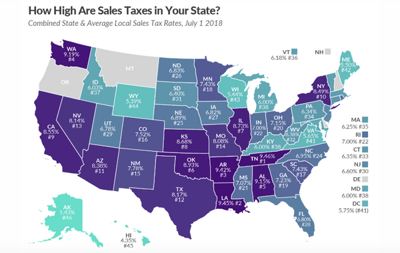

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com